9 May | 2023-24 Federal Budget Summary

Labor has forecast a budget surplus for the first time in 15 years amid an ongoing boom in commodity prices and continuing low unemployment.

Treasurer Jim Chalmers projected a surplus of $4.2 billion for the year ending on June 30 but predicted deficits in coming years.

As inflation stays uncomfortably high and the cost-of-living crisis continues to bite, Chalmers announced a raft of measures for those doing it tough.

Housing, healthcare and clean energy measures dominated the policy front alongside increases to JobKeeper and Commonwealth Rent Assistance.

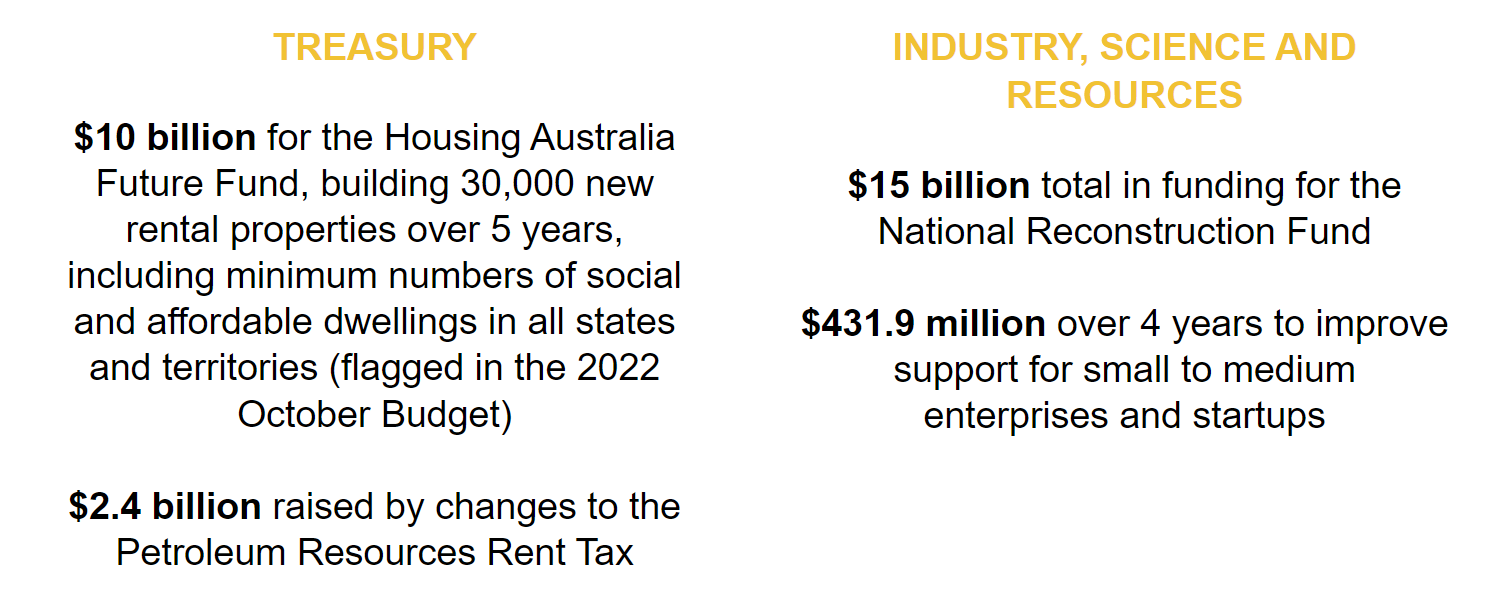

On the revenue side, the government plans to tighten superannuation tax concessions for those with a balance over $3 million, put in place a minimum domestic tax rate for large multinational companies and beef-up the Petroleum Resource Rent Tax.

But the main talking point is the return to surplus and who will claim credit for it.

Ultimately, Chalmers announced the numbers and if delivered, this will provide a significant political victory for the Albanese Government.

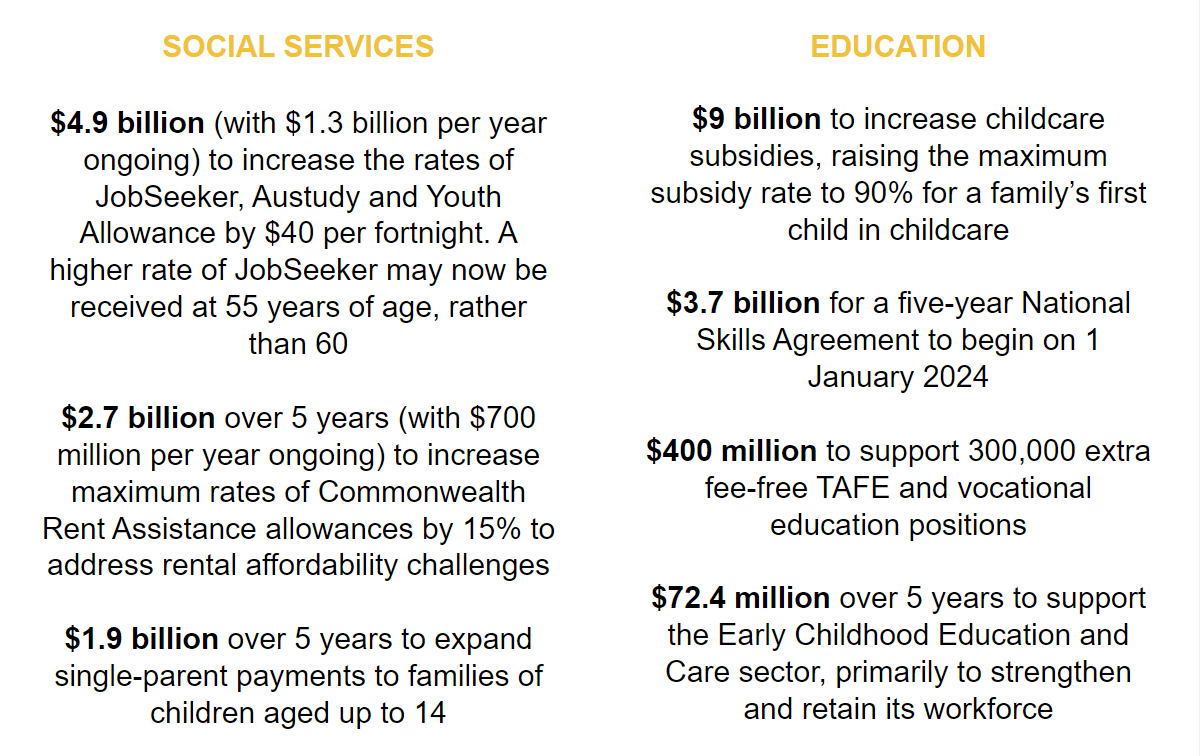

The 2023-24 Budget has made commitments in:

Significant cost-of-living relief, particularly in the form of power bill rebates, medicines, childcare and extended single-parent payments

Maintaining Stage 3 tax cuts legislated by the Coalition Government, costing $245 billion over ten years

Boosting aged-care workers’ pay

A broad response to the Defence Strategic Review, including provisions relating to AUKUS

Expanding JobSeeker payments to certain age groups

Changes to the Petroleum Resources Rent Tax and a cap on domestic gas prices per gigajoule until 2025

Reforms to Medicare and the Pharmaceutical Benefits Scheme

For full details on the 2023-24 Federal Budget please click here.