23 May | 2023-24 Victorian Budget Summary

The 2023-24 Victorian State Budget was delivered today by Treasurer Tim Pallas, who described his ninth budget as the most difficult he has had to deliver.

The Labor government’s focus was on reducing the record debt it had accumulated during the Covid-19 pandemic, while also funding its election promises.

An increased levy will be placed on large businesses, landlords and holiday-home owners to help repay the state’s debt, which will rise from $135.4 billion next year to $171.4 billion by 2027, the equivalent of 24.5 per cent of the Victorian economy.

The new "COVID Debt Levy" is a two-part tax that will remain in place for a decade.

First part: Businesses with a national payroll of more than $10 million will pay an additional payroll tax of 0.5 per cent, or 1 per cent if their national payroll exceeds $100 million.

Second part: The threshold for Victoria's land tax, which does not apply to the family home, will be lowered from $300,000 to $50,000.

The government expects the COVID Debt Levy will raise $8.6 billion over the next four years.

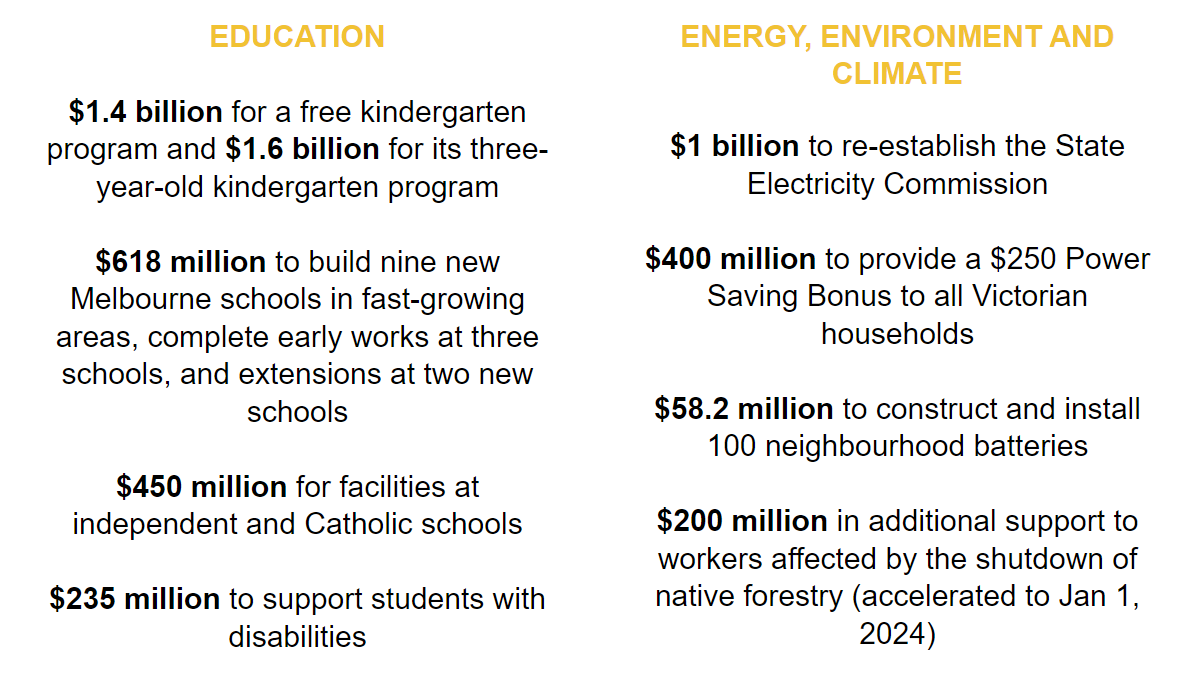

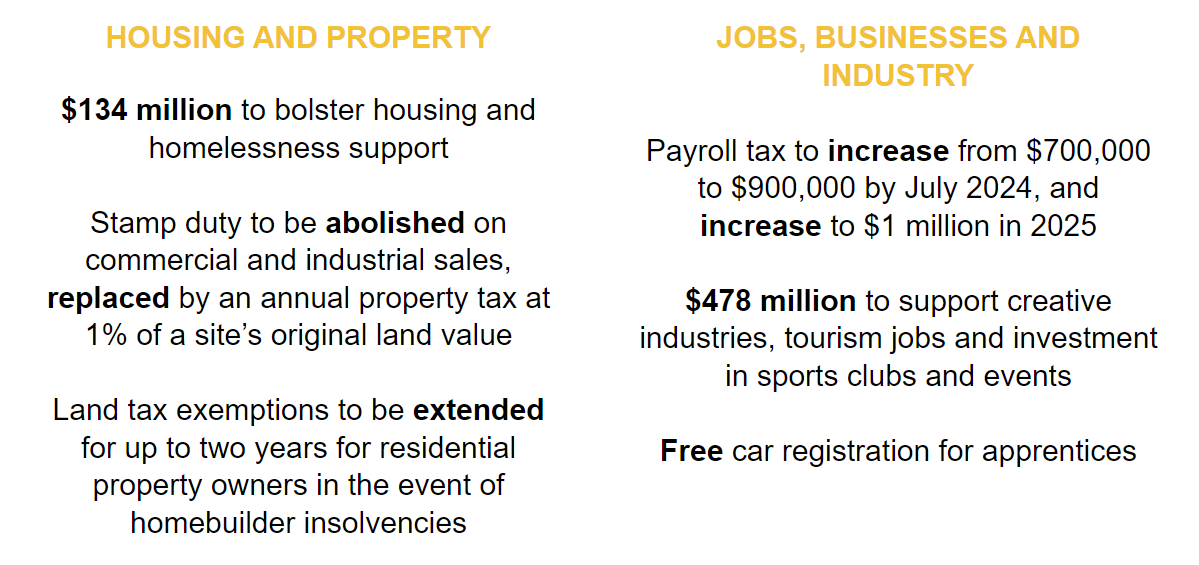

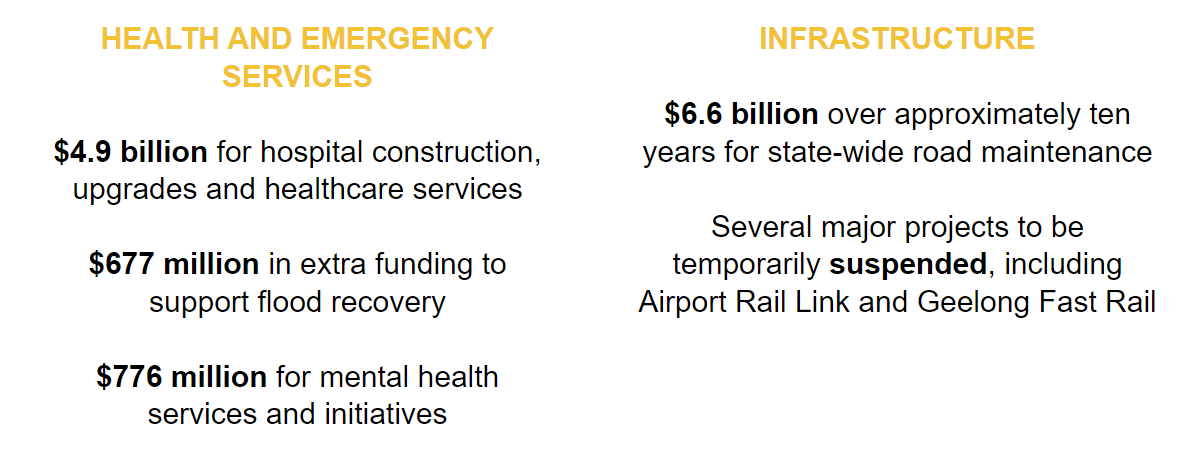

We have summarised and grouped the key budget announcements by policy area below:

For full details on the 2023-24 Victorian Budget please click here.